How much is enough?

Post-Exit Search for Contentment

Soon after a successful exit, many of us realize that the dream of financial freedom didn’t materialize the way we expected.

We’re still stressed about money - sometimes even more than before!

We start asking: Why am I not content with what I have? How much is enough?

I’ve obsessed over these questions ever since my 9-figure exit 13 years ago.

I've researched, experimented, and studied hundreds of real-life stories.

On my podcast, I interview fellow post-exit founders at different stages of their journeys.

I zoom in to deeply understand each person’s reasoning and zoom out to see the bigger picture—what happens over 10, 15, even 20+ years.

The goal is to use these diverse, thought-provoking stories to help us navigate our own tricky post-exit journeys.

My job is to discover patterns, analyze them, and break them down into digestible insights, like in this article.

I want to help fellow founders convert financial success into life wisdom so we can all build the lives of our dreams — on our own terms.

Here’s what I’ve discovered so far about how much is enough:

Yes, there’s a number.

I see an undeniable pattern: exited founders with a net worth of $100 million or more are far more likely to feel they have enough.

We proudly declare we’re no longer chasing money; now it’s about energy, adventure, and fulfillment. We call ourselves “post-economic.”

I’ve observed this trend among my podcast guests, in exited founder communities, and in UHNWI groups like Tiger 21 and R360.

Others have noticed it too.

I’m often asked whether I think $100 million is necessary to achieve the elusive sense of having enough. Do I have to keep chasing money till I have $100 million?

Let’s address this question head-on.

The answer lies in understanding two things: (1) what makes $100 million so special and (2) whether financial contentment is realistically achievable with less wealth.

So why $100 million?

It’s about ease.

Our brains are wired to choose the path of least resistance, and $100 million makes it easy to accept that we have enough.

At that level, it’s almost impossible to justify the grind of chasing more money - especially for post-exit founders who are physically and emotionally drained.

With $100 million, we feel secure enough that even poor investments won’t wipe us out. We’ve got a wide margin for error, which removes a lot of stress.

Even those who love the money game only keep playing as long as it aligns with their non-monetary goals - not with the same hunger that got them to $100 million in the first place.

Similarly, those who start new ventures tend to do so for reasons that go beyond financial gain.

There’s also the relief of finding a new identity. For founders who’ve lost their Founder/CEO status, declaring themselves “post-economic” is an attractive shift. It feels good, even empowering. And let’s face it - a pleasant decision is always easier to make.

Then, there’s the number itself. In founder circles, $100 million is often seen as a milestone. I know people determined not to sell their businesses until they hit that magic $100M. This creates a subconscious expectation that $100M means ‘enough.’

So, the wide margin for error, the joy of a new identity, and the association between $100 million and success make it easier to feel satisfied at that level.

But does it have to be $100 million?

Absolutely not.

When I zoom out and look at those with $100 million+ a few years after their exit, they often struggle with the same question as the rest of us: How do I build a fulfilling, joyful, and meaningful life - on my own terms?

The key difference is that achieving financial contentment earlier helps us avoid the most common post-exit pitfalls - like jumping into a new venture too quickly or making unreasonably risky investments out of fear and greed. These mistakes almost always waste money, time, and energy, robbing us of the chance to build the life we truly want.

This is an important lesson for all of us: financial contentment protects us from costly and painful post-exit mistakes.

Many of us sense this intuitively, which is why the question of how much is enough is such a hot topic in post-exit circles.

So, how do we achieve financial contentment efficiently, regardless of the size of our exit wealth?

While it’s easy to feel satisfied with $100 million, it gets trickier with less wealth.

Why?

Because when the decision isn’t obvious - like it is with $100 million - uncertainty creeps in. And with uncertainty comes vulnerability. We start unconsciously mirroring those around us, copying their mistakes, and losing control over our lives. This isn’t the path to financial contentment and freedom.

The good news?

We have the power to control this process. We can create contentment, regardless of our exit wealth.

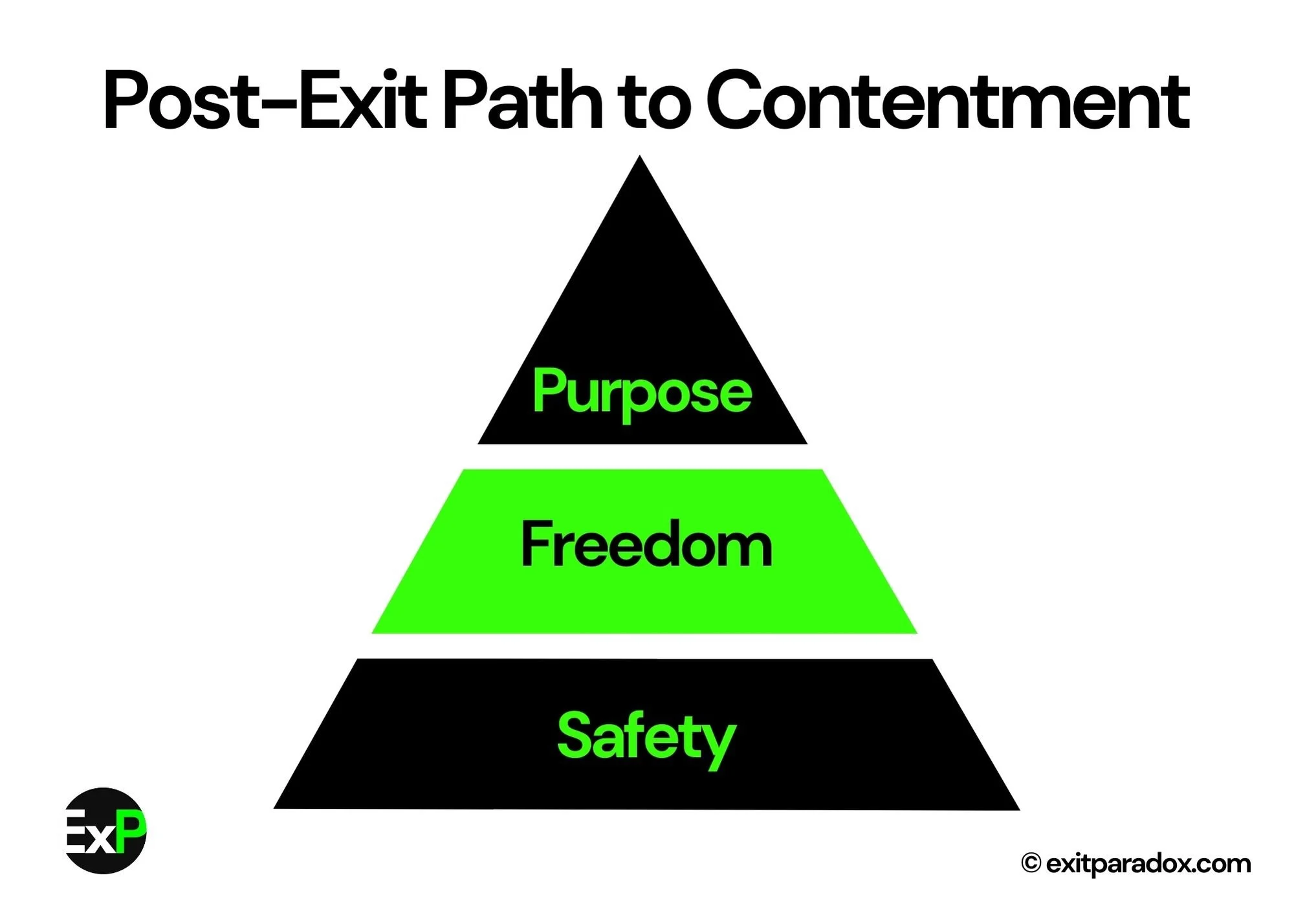

I found that - specifically for exited founders - the most efficient path involves three key steps.

3 Steps to Financial Contentment

Post-exit founders who appear to have successfully converted their financial success into deep contentment have these 3 elements in their lives:

Financial safety

Intrinsic freedom

Purpose

1. Financial Safety

Our brain's need for safety is hardwired.

Financial security sits at the base of Maslow’s pyramid.

When we lack it, our brain sees everything else - health, relationships, fulfillment - as at risk. So, it prioritizes financial safety above all else until that need is sufficiently satisfied.

Once the safety need is properly addressed, our motivation and energy naturally shift toward higher needs: love, belonging, self-realization, and fulfillment.

It is this subconscious shift in motivation that makes us feel we have enough.

I see it all the time. Exited founders who prioritize financial safety early on stop stressing about money and naturally channel their energy into other areas of life. They avoid many common post-exit pitfalls and recover from emotional volatility faster and at less cost.

Those who don’t get stuck in financial stress, despite the zeros in their accounts.

But how do we properly satisfy this safety need?

First, by realizing that our brain isn’t the enemy - it’s a guide. We just need to learn its language.

It’s telling us we’re not safe. Not yet.

The stress it creates around money has a purpose. Our job is to respect it and take appropriate action.

Second, by accepting that wealth does not equal financial safety.

True financial safety isn’t just about a number.

A bigger number in the bank may provide an initial sense of security - as it seems to do for those with $100 million+ - but that ease doesn’t last.

Our brain soon realizes that even a big number can be lost if it’s not protected. It will keep scanning for danger until we give it real security.

Until then, it will keep our focus locked on safety, preventing financial contentment - and keeping our energy blocked.

Sudden Wealth Syndrome is another factor. If we gained our wealth quickly, we might experience an "extreme fear" of losing it.

Our brain becomes overwhelmed with the unfamiliar responsibility for wealth, a sense of incompetence, and fear of failure.

It perceives this situation as an immediate threat, triggering stress and anxiety. This leads to irrational behavior.

However, most of us don’t even realize it's happening.

Years later, we are shocked by our decisions - they seem too irrational in hindsight. I experienced it myself, and so did many of my fellow exiteers and podcast guests.

Left unchecked, Sudden Wealth Syndrome can lead to serious mental health issues and financial losses.

It keeps us away from financial contentment.

So, what do we do?

We need to take deliberate action to create true financial safety.

From my observations, those who achieve this focus on three things:

A money-making machine: an automated, stable source of income that covers living expenses with a healthy margin.

Protection from black swan events, e.g. protective legal structures and insurance: health, life, and umbrella policies.

A trusted wealth team to professionally safeguard our assets.

When these are in place, our brain gets the signal that it can release its energy for other things.

Wealth-related stress fades away. Our energy gets unblocked.

Is this what most exited founders do?

Unfortunately, no.

Why?

I found 3 main reasons: wrong priorities, decision paralysis and the ease trap.

Wrong priorities.

Many of us prioritize addressing other post-exit pains like boredom, loneliness and insecurities over financial safety.

We don’t know how to address these pains properly, so we throw money at the problem. We dive into risky investments like angel deals, trading, or the next shiny opportunity.

I made that mistake too.

Looking back, I wasn’t really chasing returns. I was trying to buy my way back into the tech ecosystem, create an attractive new identity, and avoid boredom and introspection.

I lacked guidance, overestimated my abilities, and followed equally confused exited founders. Together, we amplified our ignorance and arrogance.

The result was years of emotional rollercoaster, confusion, and financial losses.

Decision paralysis.

Many of us get stuck because of so many options for our money.

Some are torn between overconfidence from our recent success and a sense of incompetence. We mistrust pros and think we can do better. We want to pick our own investments but are scared to do so.

Others hire pros but think we need our own investment philosophy and a perfectly tailored portfolio aligned with our unique wishes and circumstances.

But do we? Not if safety is our goal at this stage. A perfectly tailored portfolio is something we can create later. Once we know who we are and what we want.

Overwhelmed with choice, we end up in decision paralysis. Our impulsive attempts to break out of it often lead to losses.

I’ve seen many exited founders stay trapped in this phase for years, leaving them vulnerable to the temptation to copy others, and manipulation.

The root cause is emotional imbalance and a lack of skills - both in finance and self-regulation.

This is how we lose control, freedom and remain chronically stressed over money.

The ease trap.

Building financial safety feels like hard work, and we’re already exhausted post-exit.

We’re determined to only do what feels good and fun. After all, haven’t we earned that?

But building financial safety isn’t exciting for most. It takes time and effort.

So why should we?

Because it’s much, much harder to achieve lasting financial contentment without financial stability.

It takes longer and life is short.

The likelihood of significant waste of resources is statistically very high.

The solution is to systematically overcome the reluctance, break out of decision paralysis, and get our priorities straight.

It's all worth it. Those who do it get rewarded with financial contentment and liberated energy.

They move on to build deeply fulfilling, impactful lives.

2. Freedom

Why do some of us still stress about money, even after creating financial safety?

Often, it’s because the reasons we started chasing money are still there.

I like to ask my podcast guests what drove them to start their businesses. For most, it was the desire for financial freedom. The same was true for me.

But when we dig deeper, there’s often an underlying fear we were trying to escape - fear of poverty, rejection, failure, or feeling unloved.

To reach financial contentment, we need to stop thinking that money will resolve those fears.

We need to address them properly. Only then can we feel truly financially free.

But how do we actually do that?

Some people report good progress through therapy, and I’m sure it’s a valuable path worth exploring.

It didn’t work for me, though.

I quickly found myself dependent on it, without making lasting progress. I started craving autonomy and authenticity. I wanted to figure things out for myself.

I realized that while I love learning theory, I’m simply too skeptical to take action based solely on it. Also, theories can be conflicting.

To have enough conviction to act, I needed to learn directly from people more experienced than me who I could relate to - more experienced exited founders.

I wanted to see how, in real life, they found financial contentment.

I wondered how they moved from post-exit confusion to the kind of life I dreamt of: joyful, meaningful, and deeply fulfilling.

I wanted to feel inspired by them and genuinely driven.

And I also liked the idea of learning how to grow my wealth in a healthy, stress-free way, without spending too much time or energy on it.

But most of all, I wanted to feel truly, deeply free - free from the fears and insecurities that weighed me down.

So I embarked on a search for post-exit founders who were believably fulfilled, content, energized, authentic, impactful, and who had fully mastered their wealth.

Yes, I was looking for human unicorns.

Finding them - and getting them to share deeply and vulnerably - was no easy task!

Out of the hundreds of exited founders I’ve closely studied, I’ve identified only about 20 as "human unicorns."

Each story is unique - their family backgrounds, business histories, the size of wealth, wealth management styles, and cultural contexts differ greatly.

But there is an unmistakable common denominator.

These people operate on a higher level of spiritual development.

What does that mean?

They have gone through tremendous personal growth beyond selfishness. As a result, the "human unicorns" tend to be:

Driven by a sense of duty which gives them a sense of purpose and fulfillment

Hard-working for a non-selfish cause and willing to sacrifice for it

Genuinely caring about others and deeply loving in their personal relationships

Accepting, non-judgmental, authentic, real, and not cynical

Deep thinkers who actively avoid anything shallow

Independent, curious, critical, and radically open-minded

Present, respectful, and grateful in all communications

Appreciative of their wealth and seeing it as leverage for their purpose and vision

Intolerant of waste, whether of time, energy, or resources

None of these "human unicorns" were born this way.

For most, the journey to this state was long, complex, painful, and intentional. Those who got there earlier often had guidance, mentors, or role models - sometimes from within their own families.

They learned, experimented, practiced, and mastered the necessary skills.

They cultivated a sense of duty, compassion, and mental strength.

The hard work on their spiritual growth elevated them above selfish fears and insecurities.

It brought them financial contentment.

It brought them true freedom.

We often think of freedom as optionality - the ability to do whatever we want. But that’s just extrinsic freedom. "Freedom to" do things.

Intrinsic freedom is far more important.

It’s "freedom from" - freedom from fears, insecurities, cognitive biases, external influences, and manipulations.

Above all, it's freedom from selfishness which is the source of stress and enemy of contentment.

Intrinsic freedom is what gives us true control over our lives and leads to lasting financial contentment and fulfillment.

To achieve it we need to integrate intentional spiritual growth into our lives. We need to systematically master the skills.

3. Purpose

Once we’ve achieved financial safety and intrinsic freedom, it becomes easier to discover our purpose - the duty or work we accept, whether voluntarily or because life brings it.

It’s our contribution to the world and the source of our fulfillment.

At different stages of life, this purpose might come from raising a family, building a new venture, or focusing on philanthropy.

Its powerful pull shifts our focus away from chasing money and other selfish pursuits toward something more meaningful.

Many of us experienced this pull while building our businesses, when we prioritized non-monetary goals like our vision, customer satisfaction, or the happiness of our team.

It was when we accepted duty, sacrificed, and worked hard for it.

This is what we miss most post-exit.

After an exit, we need to learn how to uncover, accept, and cultivate our new purpose - or even multiple purposes.

Purpose breeds contentment.

This doesn’t mean we reject money or look down on it.

Our wealth can amplify our impact. We align our financial decisions with our purpose.

At this stage, wealth becomes leverage for our purpose and impact.

We may still spend time and energy earning money, but not for the sake of money itself - rather, for the sake of our purpose.

We are content with what we have and feel safe.

We are grateful, respectful, and responsible towards our wealth.

We have clarity about our wealth’s meaning - as leverage for our purpose and as the foundation for contentment and fulfillment.

One of my favorite illustrations of this is the remarkable story of my friend Vikrant Bhargava, a real "human unicorn".

Vikrant successfully transformed his financial success into a life of contentment, impact, and love by intentionally mastering safety, freedom, and purpose.

Vikrant’s company’s IPO made him a billionaire.

By the time I met him 18 years later, Vikrant had gone through a deep and painful personal transition and found clarity on his new life direction.

He had built several massively impactful projects and profitable businesses - all while mastering wealth management skills through common sense and trial and error.

Vikrant shared that after the IPO, "wealth was important to get me stability and get me freedom." Still, it took him years to build a wealth management system that actually gave him the freedom he now "finally enjoys managing."

Before the IPO, "we were in wealth creation mode," he shares. "Post-exit, I switched into wealth preservation mode." He’s happy that he did: "The fact that I have no stress on the financial side whatsoever is hugely liberating."

"The hunger, the desire to run after more money was no longer there. I was not shooting for hefty returns; it was more about just making sure that we recover inflation. It was a portfolio I would consider very conservative for most people, especially most entrepreneurs. People tend to go for racy returns, and I don't think I ever did."

These days, it's about "using the money to leverage to do what I care about."

"I am blessed to be in a place which is good," he explains. "It's a good place to be able to now consciously, properly, and at scale, leverage my wealth to do what I would really like to do…

I've been privileged to be in the position where I made money at a very early age.

What can I do with it? What's the best I can do with it and leave a mark on the world?

So that drives me, and I spend a lot of time thinking about it now."

This thinking resulted in several extremely successful and impactful projects, like building Give, - India’s largest charitable giving platform.

According to Vikrant, "today, the platform which I funded with $2-2.5M between 2010 and 2014, raises over $100M a year from retail donors."

That is an incredibly efficient impact!

On a personal level, his "purpose is to use the money sensibly, have kids that grow up to continue to be sensible, good human beings, good people. And yeah, I feel fortunate enough to feel that it seems to be working to plan."

If this isn’t a story of real success, based on the wisdom of safety, freedom, and purpose, I don’t know what is!

But what about $100 million?

Having $100 million makes it easier to commit to spiritual growth. It provides short-term contentment.

But no amount of money can buy the long-term rewards that come from working through these steps.

True freedom, contentment, fulfillment, lasting impact, and sustainable wealth - those need to be earned.

Vikrant and other "human unicorns" earned theirs.

The sooner we start, the longer we live the life we truly want, on our own terms.

We’ve earned our financial reward through hard work. Now, we need to earn the reward of lasting happiness.

Life doesn’t give us what we desire; it gives us what we deserve.